Table of Content

Generally, the home contents that are damaged or lost in such cases, as well as the damage caused to the home building, will be covered within the limits of repair costs. The insurance cover starts from the date and time mentioned in the policy under the section of Date of Commencement. You can find the date of commencement in the policy schedule. Keep in mind that your policy will not cover anything before the date of commencement even if you have made full payment of the policy premium.

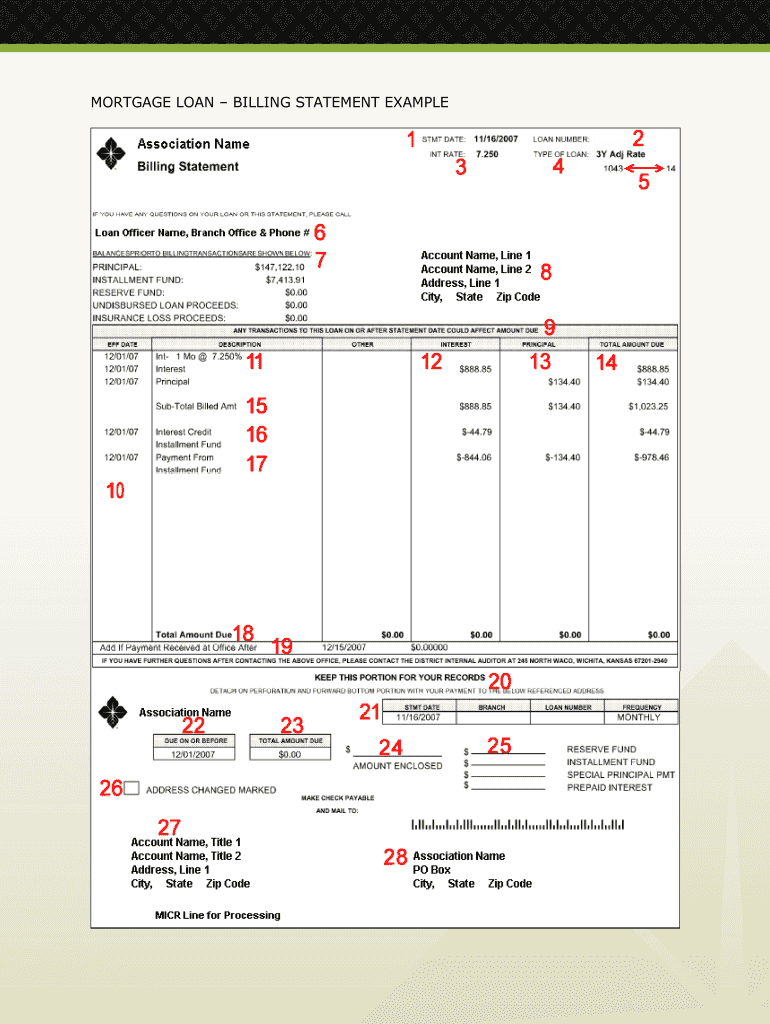

You must submit an online payment using internet banking or do what you normally do for EMIs. However, be careful to review the loan account statement next month and obtain confirmation of the same. You must visit the bank branch and notify the bank if you wish to cancel the account. Yourterm insurance planprovides you with financial security when you need it the most. If you aren't around to provide for your family anymore, the term policy payout will help them repay the loan.

How to register for auto debit through a bank’s website?

You can also opt for useful add-on covers like loss of rent, jewellery and valuables, etc. NOTE - It is important that you first confirm which mode of eNACH service would be used to register auto debit i.e., Net Banking or Debit card. Once you confirm, branch officer/agent will need to select the appropriate option and then proceed at the time of verifying eNACH bank. At the end of the revival period the proceeds of the policy fund shall be paid to you and the policy shall terminate. The policy shall continue without any risk cover and rider cover, if any, and the policy fund shall remain invested in the discontinuance fund.

The structure, thus, includes the vicinity of the building too. Building, on the other hand, means only the standalone building which is insured. It is the one place in the whole world that we can truly call our own. It becomes our responsibility to protect it from unforeseen events, forces of nature, and the ravages of time.

Home Insurance

Netbanking, Credit card, Debit card, EMI, wallets and other. Wallet – Pay renewal premium using your preferred wallet option on Quick Pay.Airtel Money, PhonePe, Reliance Jio, Payzapp,andPayTMare the available wallet options. Within the first six months of the loan, there will be a two per cent prepayment penalty for prepaying an HDFC home loan. There will also be applicable taxes, statutory levies, and charges.

Branches are closed on Sundays, national holidays and region- specific holidays. NSDL NIR provides facility to hold all type of insurance policies from various insurers in an electronic form under a singlee-Insurance Account . Once the payment is successful, the premium receipt will be sent to your communication address or email ID registered in our records. If the home loan is being prepaid in the first 6 months, then 2% of the amount being prepaid in addition to the applicable taxes and other statutory charges will be levied. You may easily prepay HDFC home loan online by using the customer portal.

Fund Performance

Check with the lender if the property that you have shortlisted can be funded. Provide all the required legal and technical documents so that the lender can carry out the necessary due diligence. If you need any further details on the application process click here to read the FAQs.

You can pay renewal premiums of In-force, Lapsed, Discontinued, Paid-up policies by cash, local cheque, demand draft using Easypay service of Axis Bank branch across India. They do not offer additional maturity benefits, making them the most affordable life insurance product in the market. You can get a life cover of INR 2 crores for just INR 1,000 per month with aterm insurance plan. Ideally, opt for a life cover that is a little more than yourhome loan amount. The payout from the policy will enable your nominee to pay off the loan without any worries. In case of monthly frequency, auto debit mandate registration is necessary to facilitate seamless premium payment for your policy.

You may ignore this instruction if the PAN is already submitted. Click hereto understand the process and follow the steps to register eCMS for HDFC Bank. Customer will receive OTP on his mobile number registered with ICICI Bank to validate the mandate. This is applicable only for exceptional service request and for the pin codes in serviceable areas.

At the end of the lock-in period, the proceeds of the discontinuance fund shall be paid to the policyholder and the policy shall terminate. A Paid-up policy will continue as per the policy terms and conditions and charges shall continue to be deducted. If the policy is not revived within the revival period or if you choose to withdraw the policy, the proceeds will be paid out as per the applicable regulations and terms and conditions of policy. Convert the policy into a Paid up policy, wherein the policy will continue at a reduced life cover based on the premiums paid, as per the applicable terms and conditions of the policy.

Payment can be made anytime during the working hours at our HDFC LIFE branch. I declare that the information I have provided is accurate & complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affiliates to call, email, send a text through the Short messaging Service and/or Whatsapp me in relation to any of their products. The consent herein shall override any registration for DNC/NDNC.

However, you should disclose the existing policy in the proposal form when you buy the second plan. Moreover, in the case of a claim, if you make a claim in both the plans, you would have to inform each insurance company about making the claim in another policy. Once the property that has been insured is sold by the policyholder, the said policyholder ceases to hold any more insurable interest in the policy.

Make sure that you fill the online application form carefully and provide all the necessary details accurately. Since you would be required to upload the documents, please save them on your computer in a PDF format. Check your loan eligibility online before starting the application process. If you have shortlisted a property, click on ‘yes’ in the next question and provide the property details ; if you haven’t yet decided on the property, select ‘no’. If you want to add a co-applicant to your loan application, select the number of co-applicants (you can have a maximum of 8 co-applicants). Under the ‘Basic information’ tab, select the type of loan you are looking for (home loan, home improvement loan, plot loans, etc.).

Click here and visit the Home category to download the home policy claim form and fill in the required details for hassle free claim settlement. Please refer the policy wordings under Home Insurance category to know more about the terms and conditions applied. Get more details on coverages and features offered by HDFC ERGO Home Insurance Plans. A Life/Health insurance policy moves into non inforce status if the premium is not paid by the end of grace period. Which means your life cover and other policy benefits will cease / reduce immediately.

HDFC Group Websites:

India has been bearing the brunt of climate change in form of flash floods and landslides. Now is the time to take action and secure your home against natural disasters. Discounts offered may vary subject to terms and conditions.Refer policy wording for policy exclusions. Electrical Mechanical Breakdown – Damage due to short circuit as payable risks. Currently there two modes with which you can repay your loan EMI. Hence, to compensate for that expense, ₹ 250 excluding taxes is charged.